Never before have we been so optimistic across all sub-segments of the shipping/oil service sectors simultaneously as we now are for 2018. All segments have either just entered the expansionary phase of the business cycle, or will experience the inflection point in 2018. Thus, we find ourselves in an extraordinary situation where a potential 109% return over the next year is being dependent on careful capital allocation. In this report, we outline our top picks for 2018 in terms of timing, segments and shares, focusing on maximizing return/risk.

Key opportunities: We have short- & long-term BUY recommendations on Dry Bulk, LNG Carriers, LPG Carriers and Rig, while we have a short-term HOLD on Oil Tankers. The latter is a tough call as we also see the largest upside in this segment over a one-year horizon. We believe Oil Tanker shares will be weak in 1H18, creating opportunity to accumulate shares ahead of the cyclical inflection point in mid-‘18.

Key concerns: As we began preparing this report in late January, our main concerns were: 1) A broad market correction/crash, 2) a significant decline in oil prices (negative for Oil Services, LNG & LPG) and 3) a significant uptick in newbuild contracting. As of today, our first concern is under development and #2 still hangs in the balance. Turmoil in the equity markets is an unfortunately part of the life of an investor, but can also be used opportunistically to rebalance the portfolio. Although not immune against broad share index movements, our universe has rather low correlations to index ranging from 0.21 (LPG Carriers) to 0.61 (LNG Carriers).

Dry Bulk: Large Upside Outweighs the Risk

The Dry Bulk segment shows continued signs of strength amidst the current low season and as we approach Chinese Golden Week (15/Feb). The BDI has averaged 1,225 YTD (+38% y/y) and Capes $15/k (+43%). We forecast steady rising fleet utilization in 2018E and 2019E with appreciating asset prices as a result. We see a 152% upside to Dry Bulk shares on average over the next year, although at a rather wide range out outcomes (σ=0.52). We reiterate our BUY on the segment as the risk/reward as highly attractive in a historical context.

Market fundamentals: We forecast 2018E to be the second consecutive year of rising utilization with demand growth of 4.4% outpacing net supply growth of a mere 1.7%. Net supply growth of 1.8% in 2019E should lead to further utilization improvements, but the recent uptick in contracting is our main concern for the segment and could lead to a cyclical inflection point in 2020/2021E. Before that, we see asset prices appreciating 42% and shares rising 173%.

Top picks: GNK (BUY, 26) has a very strong cash generation (dividend potential) and low net LTV in addition to one the highest discounts to NAV. SBLK (BUY, 21) has a similar cash story, but is currently trading close to NAV. However, a higher elasticity to asset values leads to a 1y fwd NAV on par with GNK and DSX (BUY, 6.7). The latter is also supported by a cash flow and NAV story, but ranks sub-par due to management’s conservative approach to both operational and financial leverage through the cycle (=lower dividend pay-out ratio). BULK (BUY, 198) is also a top pick being a large Capesize “pure”-play with listing in NY scheduled for 2018.

LNG Shipping is on Fire

The future for LNG as a cleaner source of energy is undoubtful, exemplified by China’s 46% y/y rise in 2017 imports. A myriad of new export capacity is scheduled for the next two years, against which a large number of new vessels are being built. We reiterate our BUY on the segment, but believe risk/reward is less attractive than at the time of our December report due to share price appreciation, a seasonally soft period ahead and as the bull case is contingent on consecutive double-digit demand growth. We downgrade both ALNG and GLOG from buy to hold, but maintain our conviction on FLNG (BUY, 16).

Market fundamentals: Spot rates for 160k cbm (T)DFDEs reached $85k/d in 4Q17, the highest rates in almost four years. We calculate a demand growth of 14% in 2017 vs net supply growth of 7%, leading to a 4%p rise in utilization to 79%. Looking towards 2018E and 2019E, we forecast annual demand growth (12-14%) to outpace supply growth (8-12%), leading to rising earnings and asset values. Recent increase in newbuild contracting and the possible delays in new export capacity are our main concerns.

FLNG (BUY, TP NOK 16): We highlight Flex LNG, mainly due to attractive earnings multiples and dividend capacity on a fully delivered basis. A P/NAV of 0.98 is also attractive given our view of asset values appreciating ~25% over the next two years. Add the most modern fleet amongst peers and Mr. Fredriksen as main sponsor, we expect the growth story to continue (LNG Carriers & FSRUs).

LPG Shipping: 1Q18 Marks the Spot

LPG shipping has moved from a scarce resource in 2014/2015 where regional LPG price differentials dictated the marginal revenue, to an oversupplied commodity shipping segment where marginal cost is the name of the game. However, we believe this will change in 2018E as vessel supply growth grinds almost to a halt and demand continues its rapid growth. We reiterate our BUY recommendation and forecast shares to rise 98% on average over the next year.

Market fundamentals: We believe 1Q18 will mark the trough and share prices to rally from seasonal and fundamental improvements in 2Q18 and beyond. We forecast a net supply growth of 0.6% q/q in 1Q18E to be followed by two quarters of negative supply growth, and an annualized growth rate below 3% throughout 2019E. This unusually low supply growth will form the foundation for the next expansionary phase of the cycle against what we forecast to be 9-10% annualized demand growth in 2018E/19E.

Top picks: AVANCE (BUY, 66) is our #1 pick trading at a P/NAV of 0.51 (peers 0.60) and 1y fwd NAV of 0.35 (0.47) even after applying a China-discount to its applicable fleet. Add historically high operational leverage and we see EV/EBITDA in ‘19E of 3.4 (4.5) and potential dividend yield of 55% (28%). LPG (BUY, 15) is ticking all the same boxes as Avance, but it ranks #2 as the discount is slightly lower across the board. BWLPG (BUY, 74) also has significant upside in our view, but the historically lower operational leverage from its industrial approach (ie COAs & TCs) means its not the best bet in the cyclical expansion.

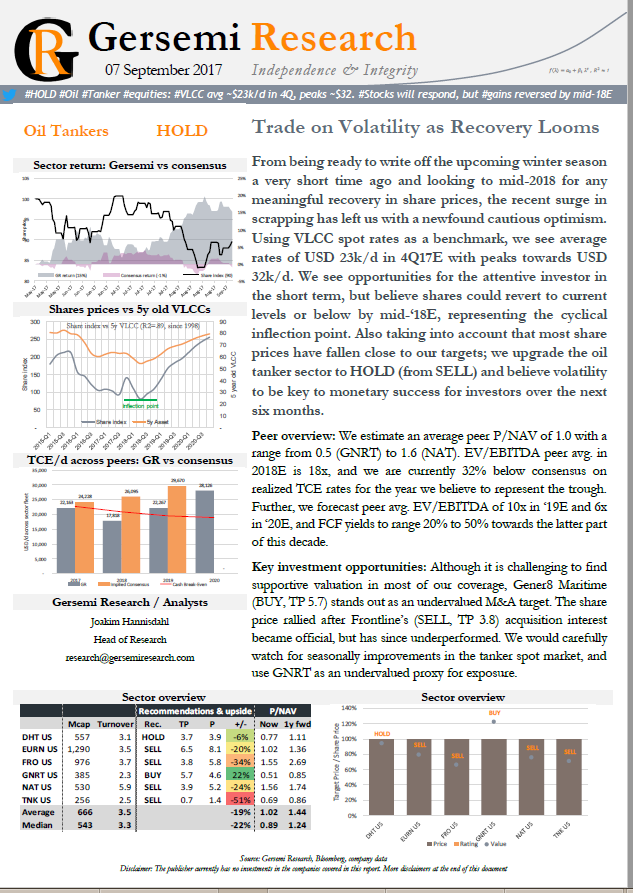

Oil Tankers: Point of Inflection Approaches

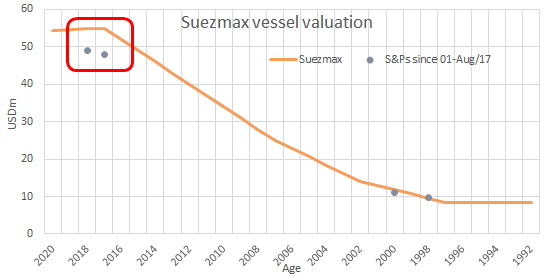

Beside a Hold recommendation during last year’s short-lived seasonal winter market, we have maintained our Sell rating on the Oil Tankers segment due to deteriorating market fundamentals since 2015. We believe the cyclical inflection point will be in 2Q18E and see shares rising 134% on average over the next year, despite short-term downside. Our best play is to use the next six months to opportunistically accumulate shares ahead of the next winter season and consecutive annual improvements. We upgrade the segment from Sell to HOLD, mainly due to share price developments since our last report.

Market fundamentals: We forecast net fleet supply of 2.7% in 2018E vs 6.1% in 2017E. The diminishing supply growth is the main reason we believe 2018E will constitute the inflection point of this cycle. Our demand growth of 0.6% in 2018E is very low, and key focus will be on OPEC’s June meeting and supply-side responsiveness to higher energy prices (i.e. US rig count). We expect demand to rise to 8.1% in 2019E on the back of strong global demand and increased exports.

Top picks: NAT (HOLD, TP 2.3) is trading at a rare discount to NAV and has by most measures successfully shored up its balance sheet. Were the company to regain yield pricing, we see $5.3/sh by 2019. EURN (HOLD, TP 8.1) recently announced the highly accretive acquisition of GNRT, the main reason we raise our TP from 6.0 to 8.1. For the less risk averse investor, we highlight TNK (SELL, TP 0.7). We see further downside amidst liquidity concerns, but a debt moratorium or other measures could be a significant kicker for the most leveraged company ahead of the cyclical upturn.

Oil Services, Rig: Improvements Ahead

Energy prices have staged a significant comeback since the trough in early 2016, and the investment cycle for energy companies has finally entered the expansionary phase. Though still early, we finally see increasing utilization and rising earnings/asset values in the offshore rig space going forward. We believe share prices troughed in 2016/2017 and forecast an average upside of 76% y/y for the segment. We reiterate our BUY recommendation and highlight BDRILL, NODL and ESV as our top picks.

Key investment opportunities: E&P companies are increasing their capex budgets and the number of FIDs are on the rise. Although rigs are experiencing abysmal utilization levels, we believe the cyclical inflection point is behind us. Our econometric approach suggests shares to rise 76% on average over the next year, with a standard deviation of 0.37 (vs 0.42 across our universe). This is attractive risk/return in our view.

Top picks: Mr. Trøim’s Borr Drilling (BUY, NOK 61) acquired a large fleet of jackups at the trough, enabling a cash break even which is below most peers. We also find the strategic partnership with Schlumberger attractive, potentially increasing fleet utilization. Former partner, Mr. Fredrisken, has formed Northern Drilling (BUY, NOK 116) to play the cycle all the time Seadrill remains in disarray. Attractive multiples on a fully delivered basis, further growth ahead and a likely M&A target. Ensco (BUY, USD 13) is the riskier bet, but with additional upside attached. Our target implies a 141% share appreciation, though contingent on the economics of its older units.

Read more as a member.Log In Register