Category Archives: LNG carriers

Weekly Wrap 30

Capesize ($23.8k/d, -4% w/w, +165% y/y) VLCC ($8.0k/d, +21% w/w, -38% y/y) VLGC ($23.0k/d, -3% w/w, +269% y/y) LNGC ($75k/d, -1% w/w, +88% y/y)...

Weekly Wrap

Capesize ($24.5k/d, +9% w/w, +179% y/y) VLCC ($6.5k/d, -14% w/w, -58% y/y) VLGC ($24.4k/d, +21% w/w, +257% y/y) LNGC ($75k/d, -4% w/w, +88% y/y)...

LNG Carriers: The Best Is yet to Come (25 page report)

As expected, LNG Carrier earnings have fallen since the peak in December. The start of the year is nevertheless the best over the past four years and spot rates are 60% above 2017 YTD. We see continuously rising annualized utilization...

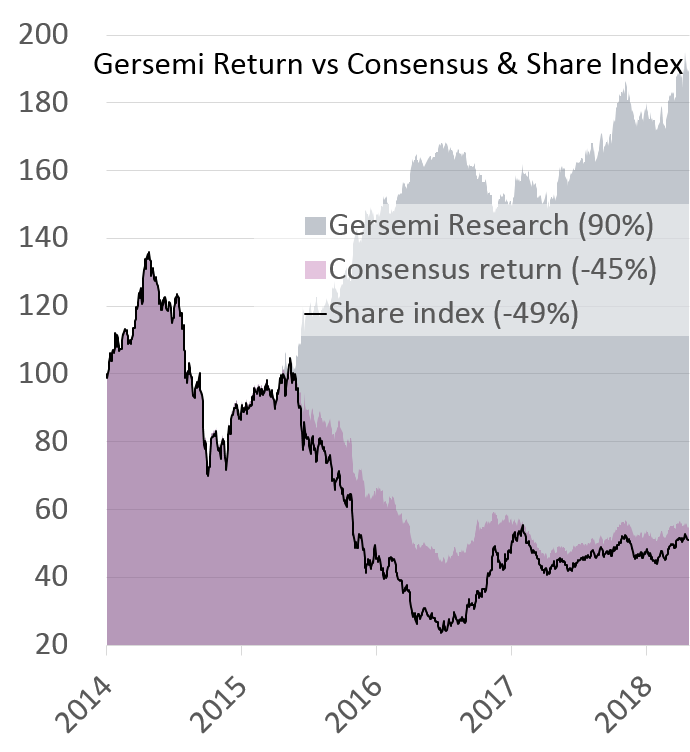

2018: Firing on all Cylinders (26-page report)

Never before have we been so optimistic across all sub-segments of the shipping/oil service sectors simultaneously as we now are for 2018. All segments have either just entered the expansionary phase of the business cycle, or will experience the inflection...

LNG Carrier Sector Update (BUY): Earnings Surge to Three-Year High

The dynamics for LNG carriers have changed and the cyclical inflection point is definitively behind us as spot rates surge towards levels not seen in three years. We see utilization rising steadily towards the end of this decade, with corresponding...

LNG sector update: Improving fundamentals

After more than two years of abysmal earnings, we now expect the worst is finally behind us. Although the recent increase in newbuilding contracting as a cause for concern, we remain confident in medium term improvements in earnings, vessel values...

ALNG-NO: Getting ready to ride the cycle (BUY, TP 5.6 [6.9])

The company today announced a restructuring and recapitalization of the balance sheet by deferring charter hire payments to Teeky LNG Partners and a private equity placement of USD ~25m through a book building process. As we touched upon in our initiation in...

FLNG-NO: Acquires two MEGI NBs (BUY, TP 17 [unch])

Flex LNG announced earlier this week the purchase of two MEGI LNGC newbuildings from Geveran (Mr. Fredriksen) at USD 180m apiece, which we view as attractive vs our generic valuation at USD 194m and as we see significant upside in asset prices over the next few years. The payment structure is 20% on completion of […]

ALNG-NO: Initiation (BUY, TP 6.9)

The company is too small for most institutional investors, and we see limited prospects for growth. Despite the share illiquidity and stretched liquidity position on our estimates, we believe there is upside to the share price based on the continued massive discount on steel and our positive sector view. We initiate coverage of Awilco LNG with a BUY recommendation and target price of NOK 6.9 (+7%).