Category Archives: oil tankers

Weekly Wrap 30

Capesize ($23.8k/d, -4% w/w, +165% y/y) VLCC ($8.0k/d, +21% w/w, -38% y/y) VLGC ($23.0k/d, -3% w/w, +269% y/y) LNGC ($75k/d, -1% w/w, +88% y/y)...

Weekly Wrap

Capesize ($24.5k/d, +9% w/w, +179% y/y) VLCC ($6.5k/d, -14% w/w, -58% y/y) VLGC ($24.4k/d, +21% w/w, +257% y/y) LNGC ($75k/d, -4% w/w, +88% y/y)...

TNK Upgraded to BUY: Our Liquidity Concerns Are Finally Mitigated

As we have argued time and again since our initiation in May 2017, Teekay Tankers would need to abolish dividends, seek a debt moratorium and/or do more sale/leasebacks in order to survive the trough without a dilutive equity issuance. In...

HUNT-NO (BUY, TP NOK 5.8) Hunter Is Hitting All the Targets (7-page report)

Since our initiation in early April, Hunter has moved ahead on its three options and have added another three to its portfolio. Today, the company announced an equity raise of gross ~$64m which would leave the company fully financed until...

Oil Tanker Sector Upgraded to BUY: Finally, Time to Tank Up

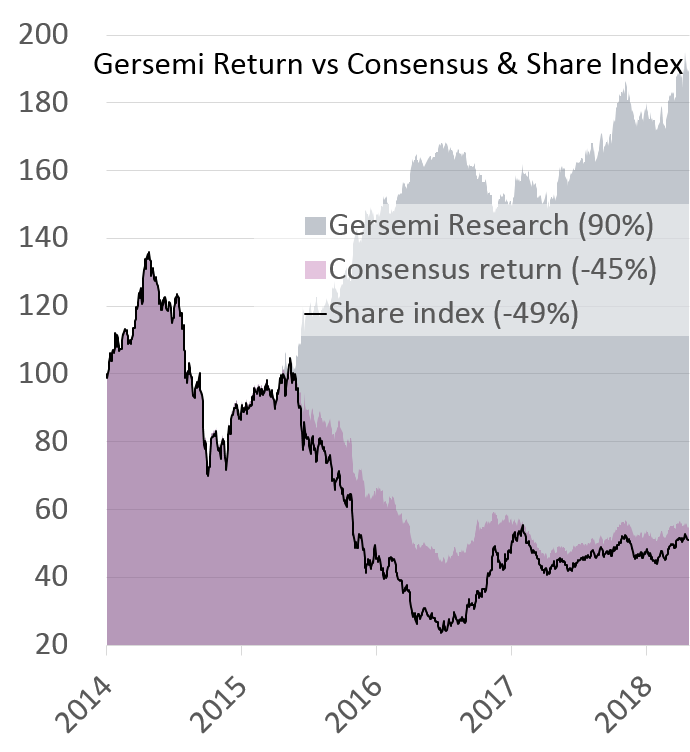

We upgrade the Oil Tanker sector from HOLD to BUY So far, we have perfectly timed our recommendations as far back as 2015 as we foresaw the cyclical peak and have since been awaiting the expected mid’18 inflection point. Given...

HUNT-NO (BUY, TP NOK 3.3): Initiation of New VLCC Pure-Play

Mr. Arne Fredly is in the process of re-branding failed Oslo-listed oil service company Hunter Group (former Badger Explorer) into a VLCC pure-play, infusing four VLCC newbuilds plus three optional berths at DSME. Given our view of ~70% asset price appreciation...

TNK (SELL, TP 0.5) 4Q17 Review: Liquidity Concerns Remain

Teekay Tankers posted 4Q17 numbers slightly above or forecast and far above consensus. More important was a liquidity position in-line with our expectations, which assuming a successful refinancing of the Aug/18 balloon payment still leaves the company in a very...

2018: Firing on all Cylinders (26-page report)

Never before have we been so optimistic across all sub-segments of the shipping/oil service sectors simultaneously as we now are for 2018. All segments have either just entered the expansionary phase of the business cycle, or will experience the inflection...

Oil Tanker Sector Update (SELL): Disappointing Winter Market

Although we cannot rule out another dead cat bounce, this year’s winter market has been disappointing. As we predicted, VLCC spot rates peaked at $32k/d, and volatility created opportunities for the attentive investor. However, oil tanker spot rates have averaged...

Suezmax Resales 10% Below Current Valuation

Summary Dong-A Spica & Dong-A Capella said to have been sold @ $48 each to two sperate Greek buyers. 10% below our current generic fair value for a similar vessel, which is under revision for downgrade. Consistent with our September...

Oil Tanker Sector Upgraded to HOLD (SELL): Trade on Volatility as Recovery Looms

From being ready to write off the upcoming winter season a very short time ago and looking to mid-2018 for any meaningful recovery in share prices, the recent surge in scrapping has left us with a newfound cautious optimism. Using...

Teekay Tankers (SELL, USD 0.7): Challenging liquidity position ahead of the cyclical trough. TP revised down from 1.2

The company recently announced the acquisition of Tanker Investments in an all-share deal on a NAV-for-NAV basis, leaving TNK’s old shareholders with ~68% of the NewCo. The two companies form a natural fit as TNK owns 11% of TIL and...

Tanker consolidation continues with TNK acquiring TIL

Teekay Tankers today announced the acquisition of Tanker Investments in an all-share deal which values TIL at a 21% premium to last close and which reflects a NAV-for-NAV transaction on our estimates. TIL’s shareholder will end up with 38% of...

DHT-US: Initiation (SELL, TP 4.0)

After an aggressive M&A attempt by Frontline that by some accounts is still ongoing but from a financial standpoint appears dead, the company acquired BW’s fleet of VLCCs through a combination of new shares and cash, and has emerged as one...

TNK-US: Initiation (SELL, TP 1.1)

Teekay Tankers has a fleet of 41 fully owned Suezmaxes and Aframax/LR2s, a 50/50 owned VLCC in addition to a handful of chartered in vessels. Despite the recently announced divestment of a 1999-built Aframax at USD 7.5m (vs our generic value at...

NAT-US: Initiation (SELL, TP 4.8)

Nordic American Tankers has a fleet of 33 Suezmaxes (incl. three newbuldings) and a 23% ownership in Nordic American Offshore worth USD 15m (USD 0.15/sh). The company is currently priced at a P/NAV of 1.8 (peer avg of 0.9) and a dividend yield...

EURN-US: Initiation (SELL, TP 6.2)

Euronav has a large fleet of crude tankers, consisting of 32 VLCCs, 23 Suezmaxes and a 50% ownership in two FSOs on long term charters. The company enjoys a large liquidity reserve and could play to role as consolidator in the...

FRO-US: Initiation (SELL, TP 3.2)

Representing the backbone of Mr Fredriksen’s oil tanker investments and spanning two decades, Frontline is still going strong after several transformational years from the verge of bankruptcy in early 2015 to the current sturdy fleet growth and pursuit of M&A possibilities. Although adding a...

GNRT-US: Initiation (SELL, TP 3.8)

Gener8 Maritime emerged in 2015 as the result of the merger between General Maritime and Navig8 Crude Tankers. The company has a fleet of 38 oil tankers trading spot, consisting of 23 VLCCs, 10 Suezmaxes and five Aframaxes/Panamaxes. GNRT is highly leveraged and...

TIL-NO: Initiation (SELL, TP 33)

Originally set up as a well-timed asset play in early 2014, the company managed to divest a small portion of its fleet before the cycle turned to recession in 2016. Thus, the focus has shifted to operations ahead of the...