Tag Archives: GNRT

Oil Tanker Sector Update (SELL): Disappointing Winter Market

Although we cannot rule out another dead cat bounce, this year’s winter market has been disappointing. As we predicted, VLCC spot rates peaked at $32k/d, and volatility created opportunities for the attentive investor. However, oil tanker spot rates have averaged...

Suezmax Resales 10% Below Current Valuation

Summary Dong-A Spica & Dong-A Capella said to have been sold @ $48 each to two sperate Greek buyers. 10% below our current generic fair value for a similar vessel, which is under revision for downgrade. Consistent with our September...

Oil Tanker Sector Upgraded to HOLD (SELL): Trade on Volatility as Recovery Looms

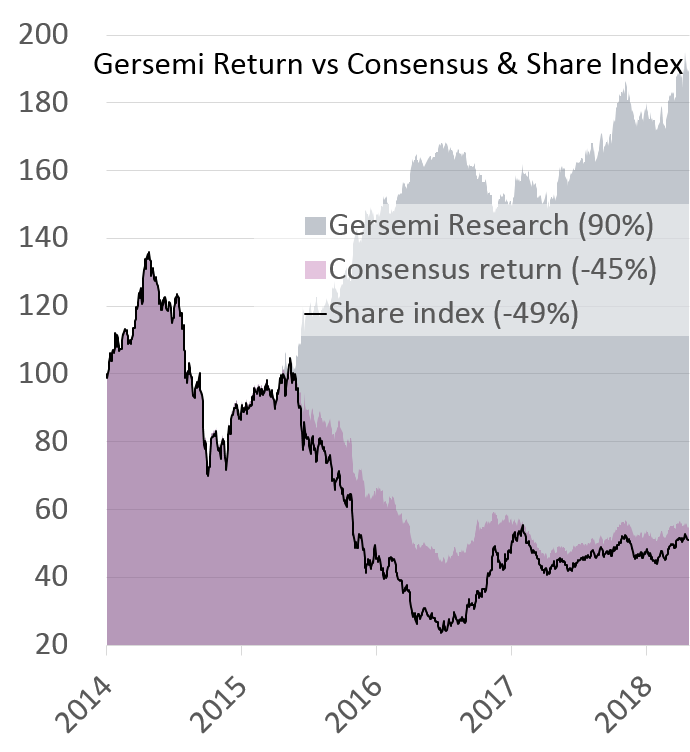

From being ready to write off the upcoming winter season a very short time ago and looking to mid-2018 for any meaningful recovery in share prices, the recent surge in scrapping has left us with a newfound cautious optimism. Using...

GNRT-US: Initiation (SELL, TP 3.8)

Gener8 Maritime emerged in 2015 as the result of the merger between General Maritime and Navig8 Crude Tankers. The company has a fleet of 38 oil tankers trading spot, consisting of 23 VLCCs, 10 Suezmaxes and five Aframaxes/Panamaxes. GNRT is highly leveraged and...