We upgrade the Oil Tanker sector from HOLD to BUY

- So far, we have perfectly timed our recommendations as far back as 2015 as we foresaw the cyclical peak and have since been awaiting the expected mid’18 inflection point.

- Given the current price of crude oil, we expect OPEC to increase quotas at the June meeting. This could be a significant catalyst for crude shipping rates from 3Q/4Q18 and beyond.

- We also expect that global oil inventory net destocking came to an end in 1Q18 and will contribute positively going forward.

- We forecast VLCCs to average $33k/d in 4Q18 (+103% y/y) and could reach peaks towards $46k/d during the winter season.

- We see 5y old VLCCs appreciate 25% over the next year to reach $75m

- We believe share prices on average could rally 50-97% by YE’18 and 87-196% over one year.

- Our top picks are: #1 DHT (BUY, TP 5.0), #2 NAT (BUY, TP 2.7) & #3 EURN (BUY, TP 10.3)

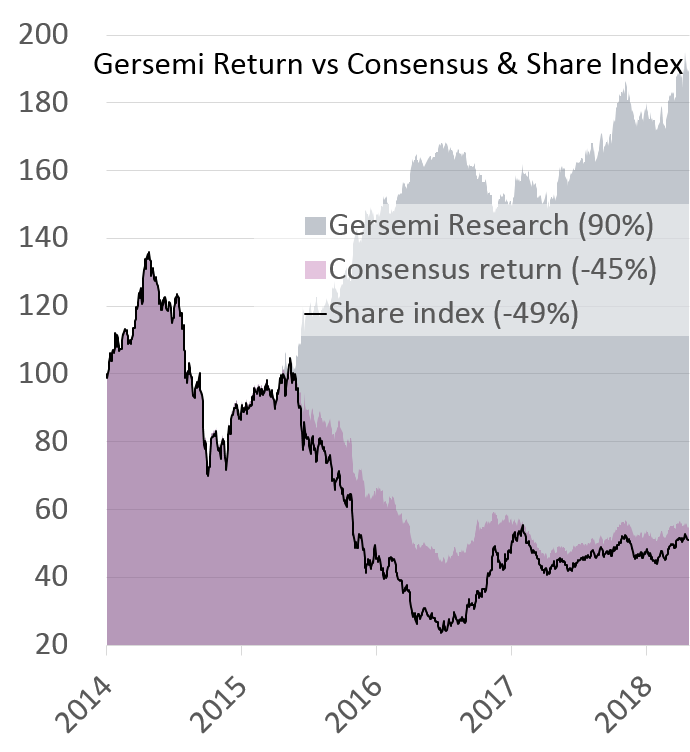

- Our Oil Tanker recommendations have returned 27% on average over the past year. This is comparative to a share index with the same shares falling 29% and consensus recommendations on the shares up 6%.

2018.05.08 – Oil tanker sector update (BUY) – Finally, Time to Tank up.pdf