Mr. Arne Fredly is in the process of re-branding failed Oslo-listed oil service company Hunter Group (former Badger Explorer) into a VLCC pure-play, infusing four VLCC newbuilds plus three optional berths at DSME. Given our view of ~70% asset price appreciation by the scheduled delivery time of the last optional vessels in 2Q20, we initiated coverage with a BUY recommendation and NOK 3.3/sh target price.

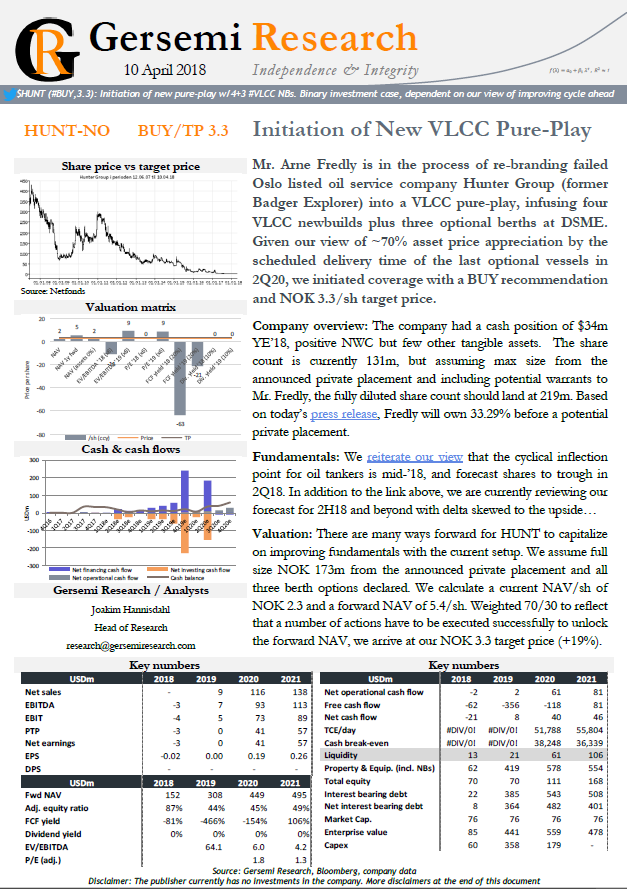

Company overview: The company had a cash position of $34m YE’18, positive NWC but few other tangible assets. The share count is currently 131m, but assuming max size from the announced private placement and including potential warrants to Mr. Fredly, the fully diluted share count should land at 219m. Based on today’s press release, Fredly will own 33.29% before a potential private placement.

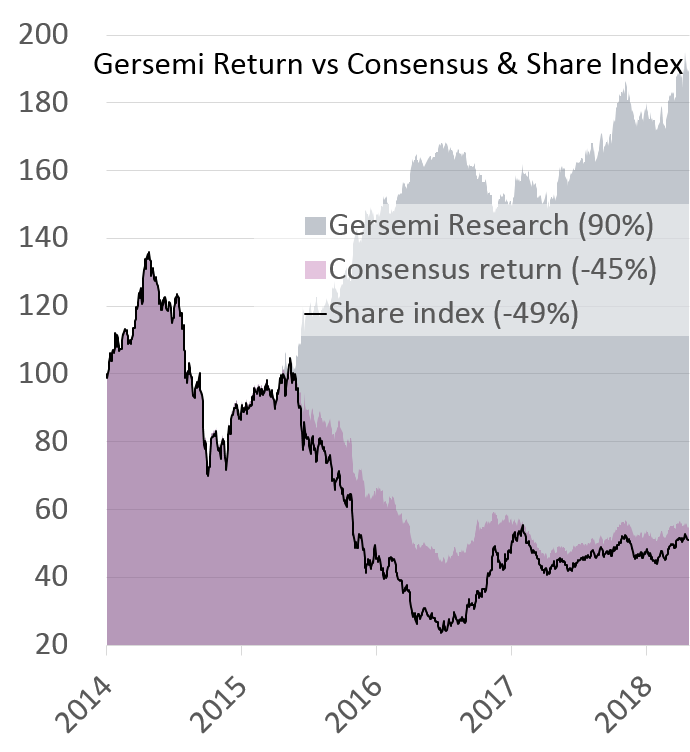

Fundamentals: We reiterate our view that the cyclical inflection point for oil tankers is mid-’18, and forecast shares to trough in 2Q18. In addition to the link above, we are currently reviewing our forecast for 2H18 and beyond with delta skewed to the upside…

Valuation: There are many ways forward for HUNT to capitalize on improving fundamentals with the current setup. We assume full size NOK 173m from the announced private placement and all three berth options declared. We calculate a current NAV/sh of NOK 2.3 and a forward NAV of 5.4/sh. Weighted 70/30 to reflect that a number of actions have to be executed successfully to unlock the forward NAV, we arrive at our NOK 3.3 target price (+19%).